Upcoming free (& non-promotional) Home Buyer Education Classes:

Saturday, 3/7 /15, from 9am-12pm

Marshall Community Center, upstairs conference room

1009 E McLoughlin Blvd, Vancouver Wa (kitty corner from Clark College)

Thursday, 3/12 /15, from 5pm-8pm

Marshall Community Center, upstairs conference room

1009 E McLoughlin Blvd, Vancouver Wa (kitty corner from Clark College)

Saturday, 3/21 /15, from 11am-2pm

Vancouver YMCA, conference room

11324 NE 51st Circle, Vancouver WA

…if these dates/times don’t work for you, we have others. Check out the website for more class dates, times, and locations. PLEASE always check the web site www.freehomebuyerclasses.com for any changes regarding the classes!

Remember…with reservation…we will throw in lunch, or dinner! 🙂

~~~~~~~~~

Good Sunday Morning!

The sun is shining, the birds are singing, daffodils are blooming, crocuses are blooming, and wait…what month is it again???? I think we will head to the zoo today to soak in some of this glorious weather! Hopefully you have something planned just as fun…and outside!

Just like everything else blooming everywhere, so is the housing market. As more and more of folks are getting their income tax refunds, they use those refunds for down payments, closing costs, and more. This is why March/April is really the start of the selling season. This is also the reason why you will see more bank owned homes & investor owned homes on the market. It is also why you will see more multiple offer situations. Because this is happening, I wanted to go over it real quick this week so that you have a handle on what these all are. As always, your questions, and comments are always welcome!

Bank Owned Homes…

These are foreclosed homes. The banks have put a price on these for sale. Usually bank owned homes are listed for less than market value because A) the bank wants to sell them quick, B) They are ‘as-is’..what you see is what you are getting, & C) the lower price encourages multiple offers which means that the homes usually sell for more than listing price. Bank owned homes can be a great way to go…Fannie Mae & Freddie Mac are really good about coming through and cleaning the home up prior to sale. The other banks??? Not so much. Banks typically can not negotiate price, what is listed is usually what they want. If the home sits on the market for long enough, the bank will drop the price, but it is something that they initiate. When writing up an offer for a bank owned home, I usually tell my buyers to talk over what their ‘highest & best’ offer may be in case of multiple offers, and to either text or email that to me. IF I receive the “we have multiple offers on this property, please have your clients submit their highest and best offer to us for consideration” email then we are prepared. If I can’t get a hold of you until after work, we will most likely lose the home. Often times the banks agent will tell me how many offers are on the table, but they can’t disclose what those offers are. We will be shooting in the dark, and sometimes you win, and sometimes you don’t. However, by asking some open ended questions, I can sometimes decipher how close we are to other offers. 🙂 If the appraisal comes in lower than purchase price on a bank owned home, the bank will take that into consideration…this is a plus with bank owned homes since if that happens with a seller owned/occupied home…sometimes they can’t or won’t. The majority of banks will not look at offers until the home has been on the market for 3 days. This gives them the increased possibility of having multiple offers. The paperwork being signed takes additional time because it has to be sent to the banks representative for their signatures. Getting the documents fully signed around can take about a week.

**SCAM ALERT** is that there are NO special lists for bank owned homes! All the bank owned homes available for sale are on the RMLS.COM website. That ‘special list’ that some agents advertise is a list of homes coming up for auction. Auctions are great and done every Friday morning at the courthouse…there are some stipulations… CASH only! There is no financing. NO contingencies like inspection, or again financing. You are purchasing the home in the current condition, whether lived in or not, and any past due property taxes/liens now become your responsibility. You know who buys homes at the auction? Investors…

Investor Owned Homes….

These are folks, or groups, who purchase a home at an auction, or HUD, or cash homes, etc with the intention of fixing them up to flip them. There are some good investors out there who do a relatively decent job, and some crappier ones. The investors main goal here is profit. They buy low, do what they need to in regard to repairs, and turn them around for a fast sell. Occasionally I have people comment that they wish they could buy them as cheap and do the repairs themselves…the problem with this is that these homes wouldn’t have financed prior to the investor fixing them up…that is why the investor (or group) paid cash for them.

These really are a good deal in most cases since the buyer is walking into a move in ready home. Also, the big plus with most of these investors is that they do repairs, and if something comes up on the inspection, or appraisal, they will do those repairs as well. The downside is that they can’t accept FHA loans for 90 days from their purchase, and there may be two appraisals that need to be paid for (buyer expense) on a purchase of these. In the case of a multiple offer, and yes, they get those too, they may send out for ‘highest & best’ offer, or they may choose to work with the strongest offer in terms of loan type, money down, and earnest money. Investors like to work with agents & lenders that they know. Again, as talked about before, this is another case where an agents & lenders good reputation helps you out. I just had something like this happen last month. Home was on the market for 24 hours, received 4 offers, and the investors agent called me back to ask if my clients could match their best offer because they preferred to work with me & our lender.

Multiple offers….

As the term implies, this happens when there is more than one offer submitted for the same property/home. It does happen more often than we would like. We are in a sellers market…. the average length of time a home stays on the market is currently 110 days, and this time period will shorten the further into spring we get. We currently have 3.6 months of inventory (homes on the market). What this means is that if there were NO more homes listed, at our current rate of sales, it would take 3.6 months to sell all those homes A ‘balanced market is around 6 months. Less than 6 months inventory= sellers market, and more than 7 months = buyers market. If the home is in good condition, in a good area, and a reasonable listing price, that home will sell at a reasonable time period. The more expensive homes tend to linger longer on the market, but some homes sell faster depending on…yep….location, location, location… and how many comparable homes in that location are on the market.

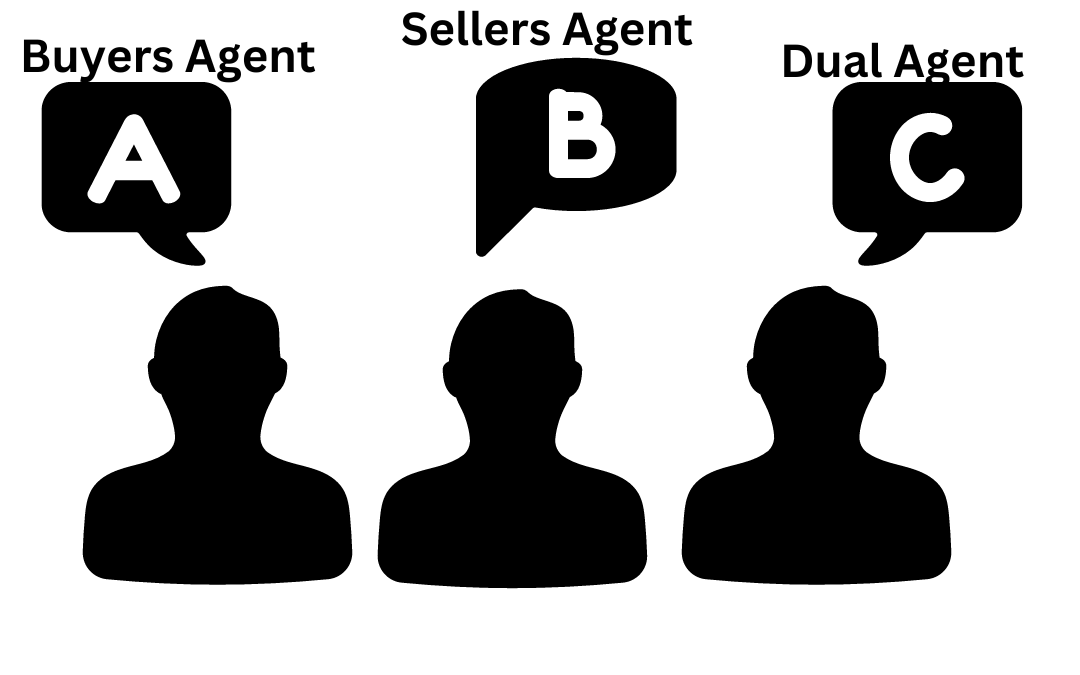

In the case of multiple offers, an agent can usually find out how many offers there are, but the sellers agent can’t really disclose what those offers are. Every situation is a bit different based on the seller, the sellers agent, and the instructions the seller has given their agent. Remember that the sellers agents job is to protect the seller and to assist that seller in getting the home sold…for as much as they can. A buyers agents job is to protect and advise the buyer…to assist the buyer in getting a home for the best ‘deal’ that they can.

In the case of a multiple offer situation, do the best offer you can (or are comfortable with), and if you win…great! If not…well, we will find you another home. There is always another home.

Usually, most sellers will ask for highest and best offers, but sometimes, they won’t. The seller does have the option of just taking the best offer on the table. Sometimes the ‘best’ offer isn’t about money….sometimes it is about strength of the offer…what type of loan, how much is the buyer putting down, how quick can they close, what are their contingencies, etc. All of those are things a seller should/will consider when looking at offers.

The seller does have the option of choosing whatever offer they want to choose. It is their house that they are selling after all.

Someone usually asks me how can we know if there are really multiple offers or not? Well, in the case of a bank, they wouldn’t say it otherwise. In the case of a non-bank owned home though? Well, most agents wouldn’t take the chance of saying that there are multiple offers unless there really are….but I can’t ask the the other agent to prove it either. Multiple offers aren’t really that great for the seller really because there is always the chance of picking the ‘wrong’ offer….the offer that backs out. Then that seller has to start all over again because most people, when their offer is not the accepted one, are going to continue their home search and most likely find a different home. Oftentimes the sellers agent will offer a back up position to the other offer.

This just gives you first dibs in case something happens to the first offer, or the first (accepted ) offer backs out. Sometimes people will go for this, but I always think of it as liking the guy/girl your best friend likes, and thinking that if they break up, you can step in. Something like that can prevent you from falling in love with a different person….err…I mean house. 😀 Buying a home is an emotional experience, and your agents (and lenders) job is to try to make the adventure as smooth as possible. We are your support staff.

One last thing you need to remember is that a real estate agent is not a sales person. It is not our job to ‘sell’ you anything. We are assistants, advisers, guidance, and help. You should not feel as if your agent is trying to sell you a home, or anything else, our job should be to help you in getting the home you want. This being said remember that you do not get T-Bone steaks for the price of hamburger…Look ONLY at homes within your budget. ALWAYS ask questions, and expect answers without a lot of lingo. I was always told that if you can’t explain something in a way that the other person can understand clearly, it is because you don’t understand it yourself. 🙂

Information is power, and I hope that I am help you! Good luck, and as always…May the odds be ever in your favor out there…. If you are looking for a real estate agent, I would love to be able to help you.

As always….this is just a quick overview…. please remember that your agent, and your lender work for YOU. You drive the bus…we are merely GPS to help you get to your goals. Like the classes, this weekly blog email is to help you with your homebuying adventure. The goal is to be informative and non-promotional. 🙂 We are, however, hoping you will call and want us to help with your adventure.

If you have any questions about this, or something you have heard…or if you would like me to help you with your homebuying adventure, please call, email, text, or facebook me anytime. I am, as always, happy to help!

Thank you again for your business and your referrals!! …and thank you for referring these classes to your friends, family, and co-workers.

. ..disclaimer…if you have already purchased a home, or would no longer like to receive these emails, please let me know and I will be happy to remove you from any further mailings…

Next Week: Closing costs…what are these & options for them?

Last Week: Buying a home, open houses, & ‘what if’s.

Have a great day, and I will talk to you soon,

;-D